by Enoch Mwathwa

Federal Reserve Governor Lisa Cook has refused to step down despite President Trump’s attempt to remove her. Cook’s lawyer, Abbe Lowell, has confirmed they will sue, arguing that the president has no authority to dismiss a Fed Governor without cause. The case sets up a historic legal battle as Trump pushes for aggressive interest rate cuts ahead of the September FOMC meeting.

Lisa Cook Challenges Trump’s Firing Attempt

Lisa Cook is preparing to fight her removal after President Trump fired her this week. According to CNBC, her lawyer said they will file a lawsuit against what he called an “illegal action.” The lawyer argued that Trump lacks any legal or factual grounds to dismiss her from the board.

Lowell stressed that the president’s attempt is based only on a referral letter. He noted that the Federal Reserve Act permits dismissal “for cause” only. This marks the first time in U.S. history that a president has fired a Fed Governor.

Trump justified the move by citing an ongoing Department of Justice probe into Cook. The investigation is linked to alleged mortgage fraud. He argued that her continued service damages public trust in the central bank. FHFA Chairman Bill Pulte backed this claim, suggesting Cook used fraudulent means to secure lower interest rates.

Cook’s removal attempt comes as Trump pressures the Fed to lower borrowing costs. Observers warn that this clash could shift the balance of power at the central bank, as more Trump-appointed Governors would hold sway.

The Political Drive for Rate Cuts

The firing attempt raises questions about Trump’s broader agenda. Market watchers believe the president seeks control of the Fed board to ensure faster rate cuts. The Kobeissi Letter noted that if Cook is removed, Trump appointees would hold four of the seven board seats, excluding Jerome Powell.

There it is:

TRUMP: “We will have the majority, shortly, on the Fed board.”

As we outlined this morning, Trump isn’t firing Powell, but he wants control of the Fed board. https://t.co/RaKmg5vbqC

— The Kobeissi Letter (@KobeissiLetter) August 26, 2025

Such a shift could pave the way for deeper cuts. Trump has called for 300 basis points of reductions, an unprecedented demand in Fed history. Analysts say this would change the pace of monetary policy at a time when inflation pressures remain.

This is not the first time Trump-linked figures have targeted Fed leaders. Last month, Rep. Anna Paulina Luna referred Chair Jerome Powell for perjury. The trend points to rising political interference in central bank independence.

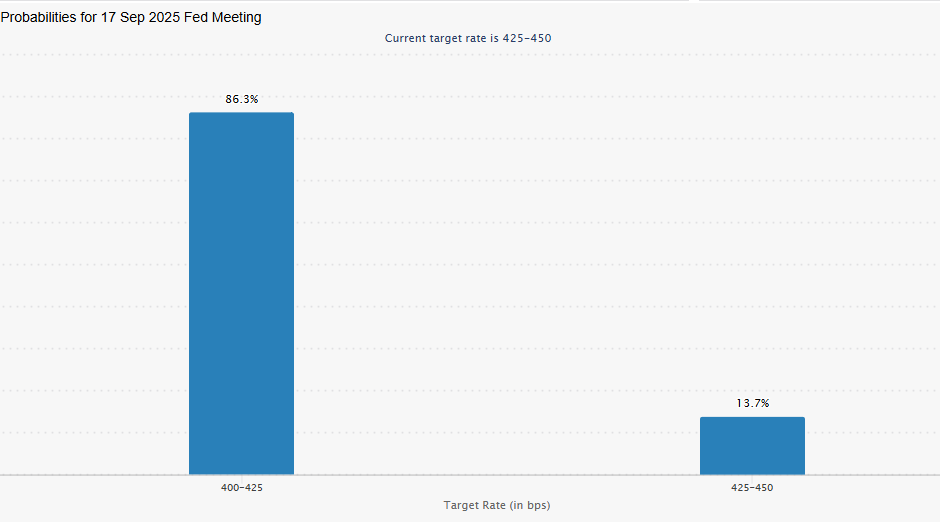

Meanwhile, markets are betting on a cut next month. CME FedWatch data shows an 86.3% chance of a 25 bps reduction at the September meeting. Traders will be watching whether the legal fight over Cook reshapes the Fed’s stance.

#blockchain #crypto, #decentralized, #distributed, #ledger