by Vincent Muthee

Bitcoin (BTC) has been having a turbulent run for the past few weeks majorly caused by president Donald Trump’s tariff threats aimed at China and Canada. These geopolitical tensions took a hit at the price of Bitcoin, with the price dropping to the $104,000 level early last week.

While the price of Bitcoin has since rebounded above $110,000, as of this writing, it has been turbulent with remarks from Trump and China’s president Xi Jinping often stirring upward and downward price actions. But despite the volatility, institutional appetite in BTC has remained high as Bitcoin ETFs continue to record inflows.

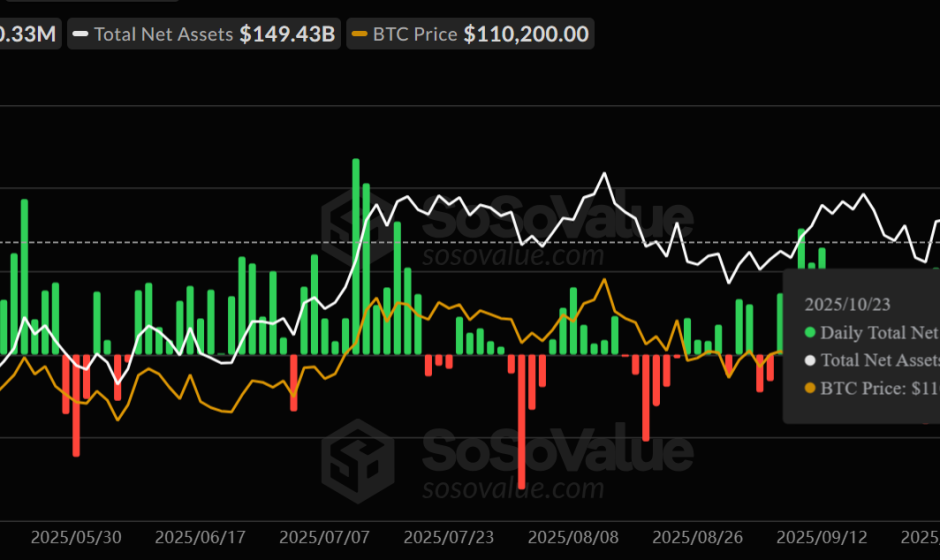

Bitcoin ETFs Record $20.33M Inflows

According to data by SosoValue, US Spot Bitcoin ETFs recorded a total of $20.33 million inflows on October 23. These inflows follow a -$101.29 million in BTC ETF outflows the previous day as Bitcoin price dropped.

As per the data, four out of the twelve US Spot BTC ETFs recorded inflows. Only 2 recorded outflows on October 23. iShares Bitcoin Trust ETF (IBIT) led the inflows with +$107.78 million. Fidelity Wise Origin Bitcoin Fund(FBTC) recorded +$7.22 million. Bitwise Bitcoin ETF (BITB) saw +$17.41 million. Lastly, Grayscale Bitcoin Mini Trust (BTC) recorded +$3.42 million inflows.

For the outflows, Grayscale Bitcoin Trust ETF (GBTC) recorded -$60.49 million in outflows. The other outflow was experienced on ARK 21Shares Bitcoin ETF(ARKB), reaching -$55.02 million. All other ETFs remained flat on the day.

BTC ETF Inflows Signal Strong Institutional Interest; Dom Harz

In an exclusive commentary to Blockchain News, Dom Harz, the Co-Founder of BOB – the Gateway to Bitcoin DeFi – believes that the recent BTC ETF inflows signal strong institutional confidence in Bitcoin. He said;

“Bitcoin’s recent fluctuations are merely a distraction from its long-term trajectory. Alongside its price hovering around the $109,000 mark, we have seen net Bitcoin ETF inflows rise past $470 million, underscoring strong institutional confidence in the digital asset.”

In fact, Bitcoin ETFs outperformed Ethereum ETFs on October 23rd. This is despite ETH tokens seemingly experiencing stronger interest. The Ethereum ETFs recorded -$127.51 million outflows, as per data by SosoValue. The cumulative net Bitcoin ETF flows have thus outpaced Ethereum ETFs by over 3 times.

The Future of BTC? Bitcoin DeFi

Dom Harz further highlighted that Bitcoin is now transitioning into a global financial asset. This transition is in turn attracting technical progress within Bitcoin DeFi. Bitcoin DeFi refers to the use of Bitcoin (BTC) within decentralized finance (DeFi) ecosystems. It enables financial services like lending, borrowing, and trading without centralized intermediaries. It allows users to earn interest, trade, or use their BTC as collateral. This expands its utility beyond a simple store of value.

“Institutions holding BTC want to put their assets to work, and that’s where Bitcoin DeFi comes in. We are witnessing Bitcoin transition from a fringe asset to one that is rooted in the global financial system, and technical progress within Bitcoin DeFi is moving in step,” Harz remarked.

Bitcoin DeFi integrations can happen through sidechains, smart contract platforms, or tokenized versions of Bitcoin on other blockchains. As per the BOB co-founder, the main aim is to foster Bitcoin utilization in DeFi, a sector now conquered by Ethereum.

“The foundations being built today, including hybrid chains like BOB, are transforming Bitcoin from a static asset into a programmable financial infrastructure, fit for institutions,” he said.

Strong inflows across Bitcoin ETFs show huge demand for BTC by institutions. With heightened institutional interest, advancements in Bitcoin DeFi are thus crucial to ensure that these investors get the most value out of their Bitcoin. In turn, increased utility could eventually bolster the price of Bitcoin in the coming days.

#blockchain #crypto, #decentralized, #distributed, #ledger