by Enoch Mwathwa

Bitwise is moving closer to bringing the first spot Dogecoin ETF to the U.S. market, revealing its ticker, fee structure, and custodian details as the final approval deadline approaches. With the SEC’s decision date set for November 12, the crypto community is now closely watching to see whether the fund will receive an official green light or become auto-effective later this month.

Bitwise Prepares for November Launch Window

Bitwise filed a fourth amendment to its spot Dogecoin ETF application, laying out key updates that signal readiness for imminent market entry, according to an S-1 filing with the US SEC The ETF will trade under the ticker BWOW on NYSE Arca. The trust aims to track the spot price of DOGE using the CF Dogecoin-Dollar U.S. Settlement Price Index, giving investors direct exposure to Dogecoin without the need to hold the asset themselves.

Coinbase Custody will secure the DOGE holdings, while BNY Mellon will manage cash-related operations. This setup reinforces institutional-grade safeguards, a key factor for regulatory comfort. Bitwise itself will serve as the seed capital investor. The firm has already committed to purchasing initial shares and also plans to acquire an additional $2.5 million worth of shares at launch.

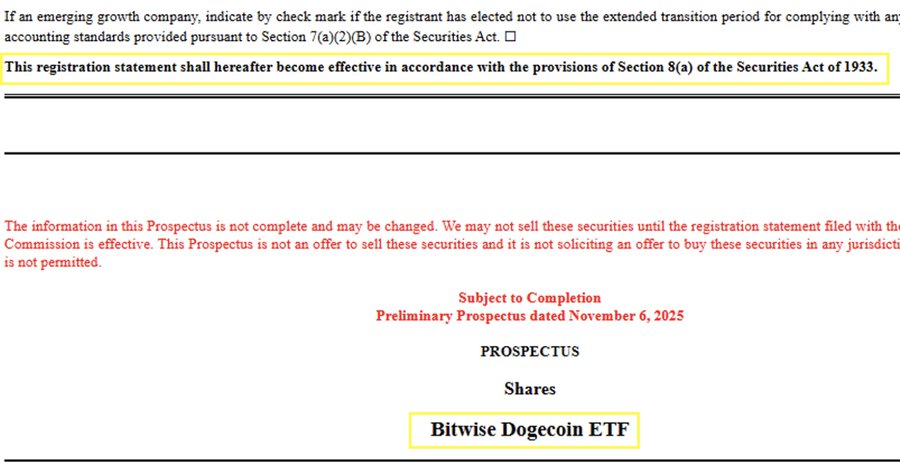

The filing also outlines that Bitwise will introduce the ETF through the standard listing process and could proceed without direct SEC approval. Bloomberg’s Eric Balchunas highlighted that Bitwise is using the 8(a) auto-effect strategy, which allows the ETF to go live 20 days after filing, unless the SEC intervenes. This means trading could begin even if the SEC does not offer a formal ruling by the November deadline.

Fee Waiver Sparks Momentum as DOGE Price Reacts

Bitwise disclosed a 0.34% management fee for the Dogecoin ETF. However, it plans to waive the fee entirely for the first month on up to $500 million in DOGE assets. This mirrors strategies seen in recent Bitcoin and Ethereum ETF launches, where fee waivers drove strong early inflows and captured trader attention.

The Dogecoin market responded quickly. DOGE price climbed to $0.166 after the news, with derivatives markets showing increased buying interest. Open interest in DOGE futures jumped more than 2%, signaling renewed speculative activity. Still, trading volume dipped slightly, suggesting traders remain cautious due to recent volatility across the crypto market.

Bitwise is not alone in this race. 21Shares has also updated its spot Dogecoin ETF application, securing the ticker TDOG for a Nasdaq listing. With multiple issuers now competing to be first to market, the Dogecoin ETF space is shaping up to be one of the most active new fronts in the crypto ETF landscape.

As the decision deadline approaches, all eyes turn to Washington. The coming week could mark a pivotal moment not only for Dogecoin, but for meme-asset legitimacy in mainstream finance.

#blockchain #crypto, #decentralized, #distributed, #ledger