by Vincent Muthee

The native token of the Binance-backed decentralized exchange Aster – ASTER, is making headlines today across the crypto market. The coin has surged by over 37% over the last 24 hours, a move that has placed it as the most trending coin of the day, on Coingecko.

ASTER’s strong rally comes despite the prevailing sell-side pressure across the crypto market. This pressure has left Bitcoin (BTC) and Ethereum (ETH), for instance, plunging by close to 1% over the same period.

ASTER’s 37% Price Pump

Since its launch on September 17 2025, Aster has experienced strong demand due to the strong backing of ex-Binance CEO Changpeng Zhao. Still, it has also faced criticism from several industry experts, which saw its price tumble a bit before the recent take-off.

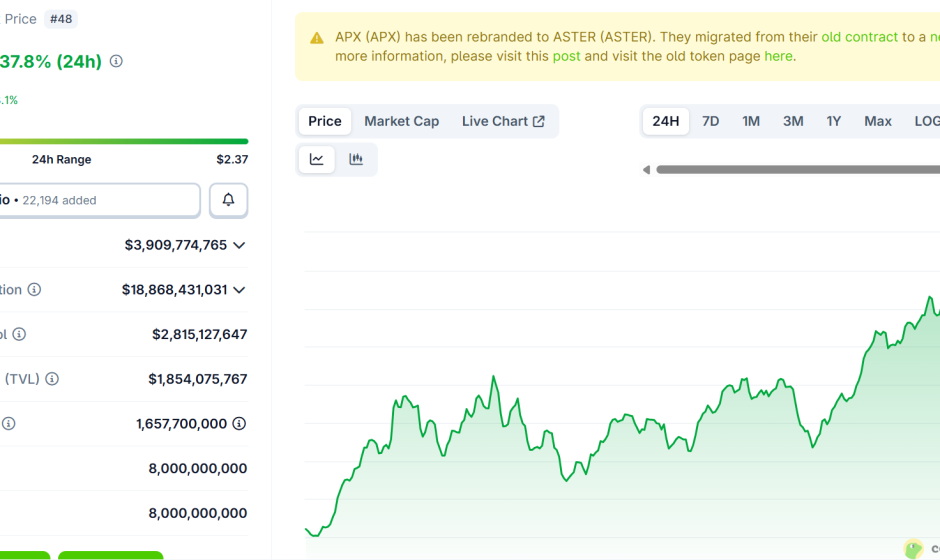

Over the last 24 hours, ASTER has surged by 37.8% to reach an all-time high price of $2.38. On the weekly timeframe, the coin is up by over 2600%, per Coingecko, highlighting the strong price momentum.

Its market capitalization has also climbed to $3.90 billion on the backdrop of strong investor interest. Meanwhile, Aster’s trading volume over the last 24 hours has surged by over 53% to $2.81 billion, confirming strong market activity around the coin.

Besides impressive price performance, Aster is also making headlines as the decentralized exchange with the highest Perpetual trading volume over the last 24 hours. As observed by Degen News, the DEX has recorded a total of $21.112 billion in perp trading volume over the last 24 hours.

Aster surpasses Hyperliquid’s perp trading volume by more than double, as Hyperliquid only recorded $9.72 billion over the same period.

Other DEXs including Lighter, edgeX and Paradex only managed $6.892 billion, $5.062 billion and $860.21 million in 24-hour perp volume. This leaves Aster on top of the list.

Smart Money Signal Continuation of Bullish Momentum

Furthermore, ASTER’s Smart Money Index (SMI), as per the 4-hour chart on TradingView, shows a bright future ahead. In particular, the coin has an SMI reading of 2.86, after a strong uptrend.

Such a reading shows that the recent price rally has received strong backing from key token holders. Smart money is the capital one operated by institutional investors or experienced traders who have a better understanding of market direction and timing.

The SMI measures their activity by examining the intraday price changes. In particular, it compares morning selling, dominated by retail traders, and afternoon buying, dominated by institutions.

When this momentum indicator is moving upwards, as in the case of ASTER, it means that smart money is accumulating the coin, signaling a continuation of the rally. However, the SMI of Aster is flattening after a strong uptrend.

Key Price Levels for ASTER

As per the 4-hour chart, if Aster faces continued backing by bulls, the key price could continue to rise. At the current level, the coin is already at an all-time high level. However, continued momentum could push it towards $2.50, marking a new ATH for the coin.

Nonetheless, with the SMI index flattening after a strong bullish momentum, there is potential for a momentum slow down in the coming sessions. In case Aster slows down and a wave of profit-taking strikes, the price could dip towards key support levels.

At the moment, ASTER is facing immediate support at $2.22. A drop below this level could see the price drop to the next support at $1.86. A breach of this level could send ASTER even lower to $1.58, thus invalidating the bullish outlook.

#blockchain #crypto, #decentralized, #distributed, #ledger