by Vincent Muthee

Bitcoin (BTC) has dropped below $80,000 amid strong sell-side pressure. The drop now pushes the king crypto to a new yearly low, adding to fears of a further dip towards $70K.

Top altcoins, too, dropped in tandem as liquidations surged across the market, leaving retail and institutional traders rattled. But what is causing the crypto market plunge?

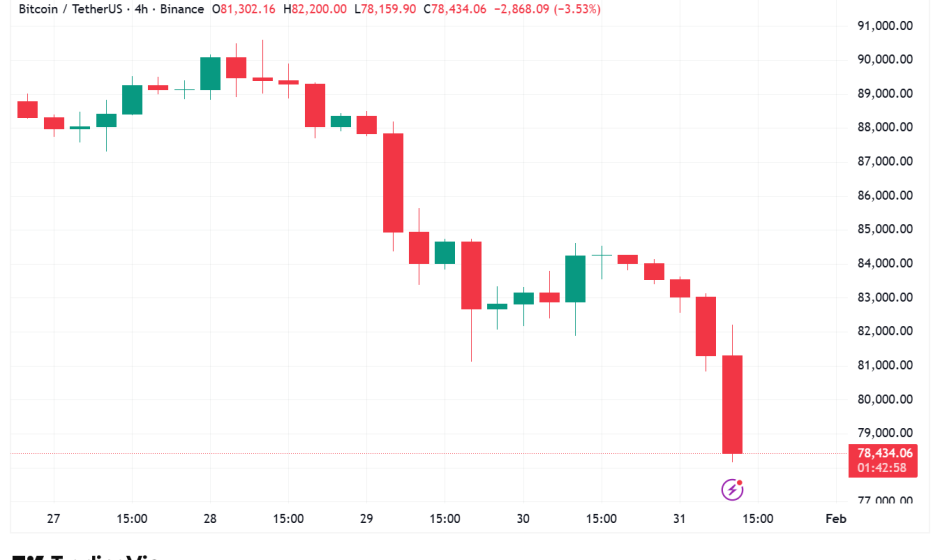

Bitcoin Dips Below $80k

According to TradingView data, Bitcoin dropped below $80k on Saturday, to trade at $78,434 as of press time. This dip marks a 5% drop on the day, extending the weekly losses to over 12%, a move that caused more pain to traders.

The Bitcoin plunge comes amid rising macroeconomic pressure and increased sell-side pressure from Bitcoin ETFs. In particular, the Fed kept interest rates steady earlier in the week, even as Jerome Powell indicated a hawkish pivot amid concerns about elevated inflation.

Bitcoin ETFs, too, have added sell-side pressure as BTC ETFs recorded $509.70 million in net outflows on January 30, according to Coinglass data. The Friday outflows marked the fourth day of redemptions in five trading sessions.

Crypto Liquidations Top $2.3 Billion as Altcoins See a Deeper Plunge

Bitcoin’s price drop triggered a significant drop across top altcoins. Ether, for instance, has dropped to $2,300, a 13% dip on the day. Other altcoins, including XRP, Solana, Dogecoin, and Cardano, recorded a double-digit dip over the past 24 hours.

This dip across top altcoins has pushed crypto liquidations to the roof. According to Coinglass liquidation data, over $2.3 billion has been wiped from the crypto market over the past 24 hours, with the number of traders liquidated topping 409,251.

The rise in crypto liquidations adds to the sell-side pressure as top analysts expect a deeper plunge across Bitcoin and altcoins. Veteran crypto trader Peter Brandt recently predicted that Bitcoin could drop to as low as $66,000 amid the ongoing crypto volatility.

Digital Assets Treasuries Tread Rough Waters

Amid the drop across top cryptocurrencies, several digital asset treasuries (DATs) are now treading rough waters. With Bitcoin now at the $78,000 level, it risks a drop below the average price of Strategy’s BTC holdings. The firm led by Michael Saylor now holds a total of 712,647 BTC, which it acquired for $54.19 billion at an average price of $76,037 per Bitcoin.

A drop below this average price triggers unrealized losses for Strategy’s BTC holdings. On the other hand, Tom Lee’s Bitmine sits approximately -$6,000,000,000 in ETH after the recent Ethereum price drop, according to Ted Pillows.

Tom Lee.

-$6,000,000,000 $ETH. pic.twitter.com/bnonqYYoYr

— Ted (@TedPillows) January 31, 2026

Not until the crypto market recovers will digital asset treasuries continue to experience unrealized losses.

#blockchain #crypto, #decentralized, #distributed, #ledger