by Enoch Mwathwa

U.S. stocks posted modest gains on Monday, while investors monitored tariff news and ongoing pressure on the Federal Reserve. Meanwhile, Bitcoin continued its strong momentum, reaching another all-time high above $123,000, supported by ETF demand and corporate treasury interest.

Dow Jones Edges Higher Amid New Trump Tariffs on Mexico and EU

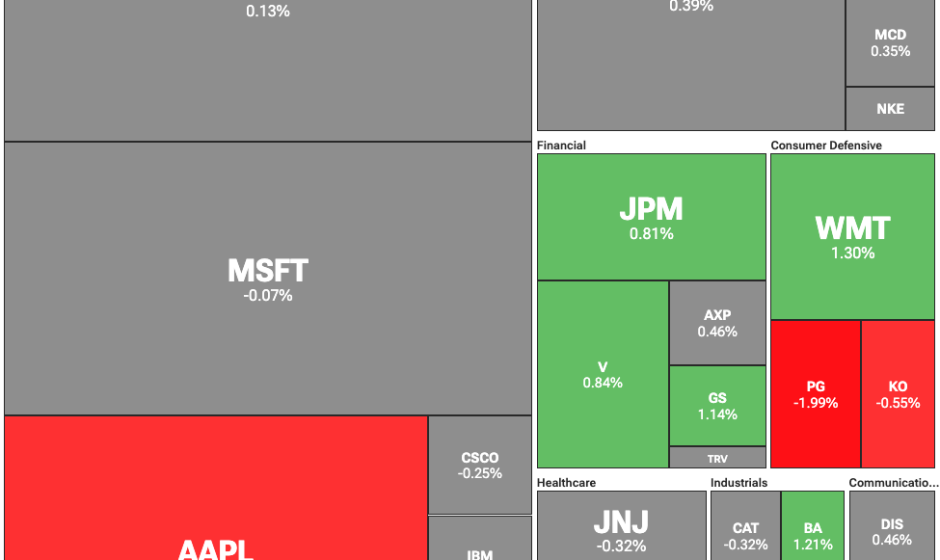

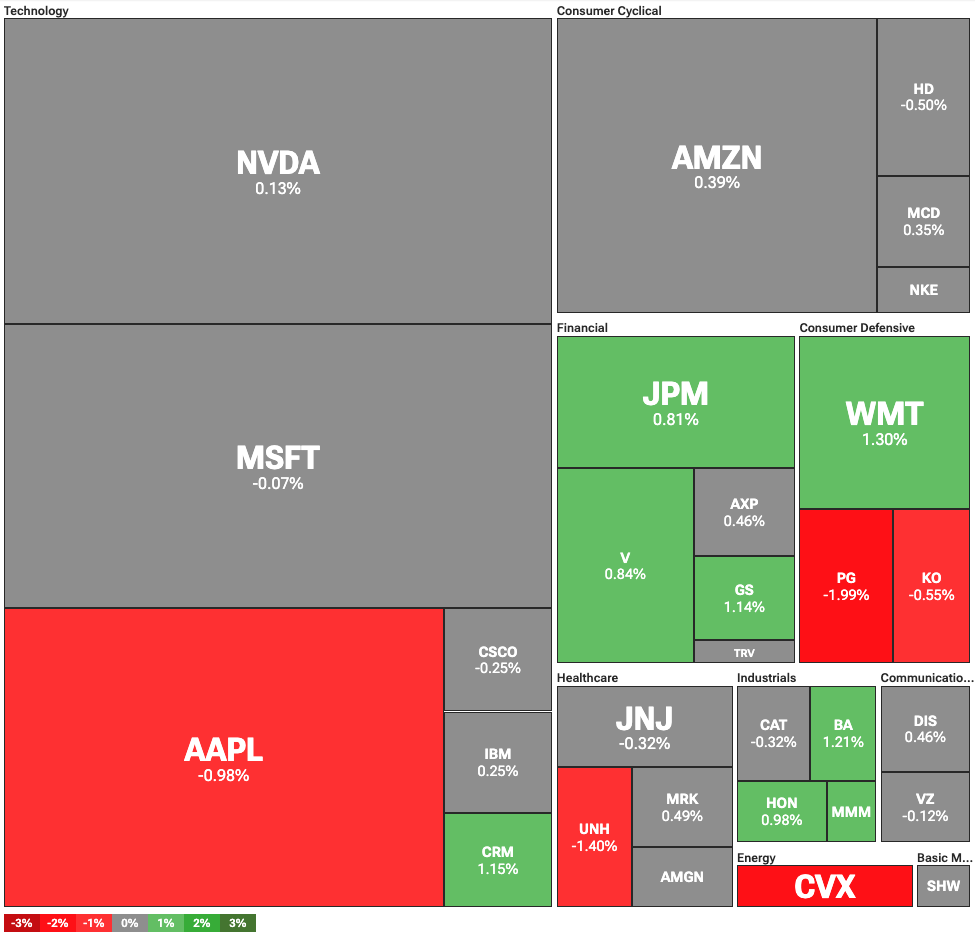

On July 14, the Dow Jones Industrial Average rose 50 points, or 0.11%, while the S&P 500 and Nasdaq added 0.11% and 0.32%, respectively. The gains came despite investor caution surrounding new tariffs introduced by President Donald Trump.

The administration announced a 30% tariff on imports from Mexico and the European Union, effective August 1. Both are major U.S. trade partners, and the decision sparked concerns about global trade relations. Negotiations are ongoing, with Mexico and the EU seeking reduced tariff rates.

Investors are also watching whether the tariff move is part of a broader trade strategy or a temporary negotiating tactic. Market participants are adjusting positions in response to uncertainty in the global trade environment.

Bitcoin Climbs Past $123K As ETF Demand Stays Strong

As equities dealt with caution, Bitcoin reached a new high of 123,091 dollars according to CoinMarketCap. The rise in prices can be attributed to the increased interest in spot bitcoin ETFs among investors and increased adoption by companies in putting BTC on their balance sheets.

There have been inflows and high trading volumes in ETFs that have managed to lead to a continued rise in prices. The altcoin market is also increasing in volumes and prices due to the Bitcoin momentum.

The institutional interest keeps rising, and the largest funds and corporations are becoming more exposed. It is observed by market analysts how long the rally would extend, as inflows rise and the asset is limited. The trend is moving the portion of total crypto market cap towards record levels in the case of Bitcoins.

Fed Faces Scrutiny Over $2.5B Renovation Plan

There has been renewed interest in targeting the Federal Reserve due to a plan to renovate its Washington headquarters worth $ 2.5 billion. The opponents can be found among officials at the White House and former heads of a central bank, who criticize it for being too expensive and over budget.

According to senior economic adviser Kevin Hassett, the plan is wasteful, and there is likely to be an investigation. Kevin Warsh, a former governor of the Fed, also blasted the renovation, telling people that the costs are outrageous.

The criticism is an addition to the political pressure that is currently facing. President Trump has already urged the interest rates to be reduced and has criticized the Federal Reserve decisions. The renovation question can also affect the debate on leadership and financial policy of the Fed.

#blockchain #crypto, #decentralized, #distributed, #ledger