by Enoch Mwathwa

Michael Saylor’s Strategy is doubling down on Bitcoin once again. After pausing its weekly purchases for a week, the firm has resumed accumulation, taking advantage of the recent crypto market dip that pushed BTC to its lowest level this month.

Strategy Adds 220 BTC Worth $27.1 Million

Strategy confirmed the acquisition of 220 Bitcoin valued at $27.1 million in its latest filing. The company bought the coins at an average price of $123,561 per BTC, increasing its total holdings to 640,250 BTC. The entire portfolio is now worth over $47.38 billion, purchased at an average cost of $74,000 per coin. The firm also reported a 25.9% year-to-date yield on its Bitcoin holdings.

To fund this latest purchase, Strategy sold portions of its STRF, STRD, and STRK shares, raising $19.8 million, $5.8 million, and $1.7 million, respectively. The move follows co-founder Michael Saylor’s cryptic post on X, where he hinted at a buy with the caption “Don’t Stop ₿elievin,” alongside the company’s BTC portfolio tracker.

Don’t Stop ₿elievin’ pic.twitter.com/LUMroqLSCl

— Michael Saylor (@saylor) October 12, 2025

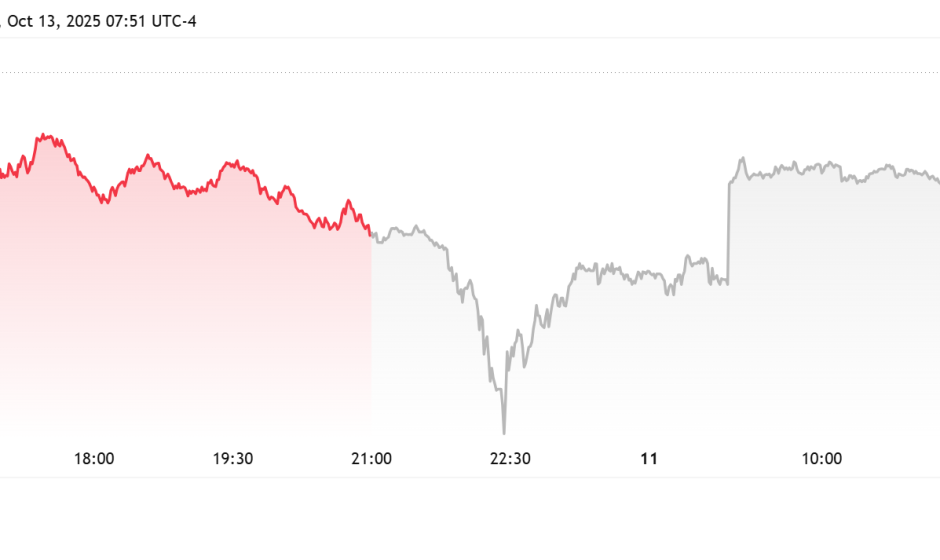

This acquisition is made in a highly volatile market. Bitcoin price dropped to a low of below $104,000 briefly following the announcement of a 100 % tariff on China by President Trump, leading to panic in the global markets. Although the storm has hit, Strategy does not see market dips as long-term purchase plans, and it is committed to pursuing its Bitcoin accumulation plan.

Market Crash Fails to Shake Saylor’s Conviction

The timing of the purchase is notable. It followed one of the largest liquidation events in crypto history, wiping billions from the market in hours. However, the steady purchasing pattern of Strategy reflects the confidence that Saylor has in Bitcoin and its future worth.

The company had previously acquired Bitcoin for nine weeks straight, including the largest acquisition in July, having purchased 21,021 BTC worth 2.46 billion. This most recent action is an indication that the company is not deterred by the short-term fluctuations.

In the meantime, the MSTR stock is not trading well, even after the news of purchases, with the prices standing at 307 in pre-market trading. The stock has fallen 13 percent during the past five sessions and is still way short of its 2025 high, which is 455. Even so, investors see Strategy’s steady accumulation as a bullish signal that reinforces its reputation as the largest institutional Bitcoin holder.

#blockchain #crypto, #decentralized, #distributed, #ledger