by Vincent Muthee

Ondo Finance has announced the official launch of its new Global Markets trading platform, targeting the provision of tokenized versions of US stocks and ETFs to users of blockchain globally. The firm launched the platform today with over 100 tokenized holdings, consisting of some of the biggest companies listed on Wall Street.

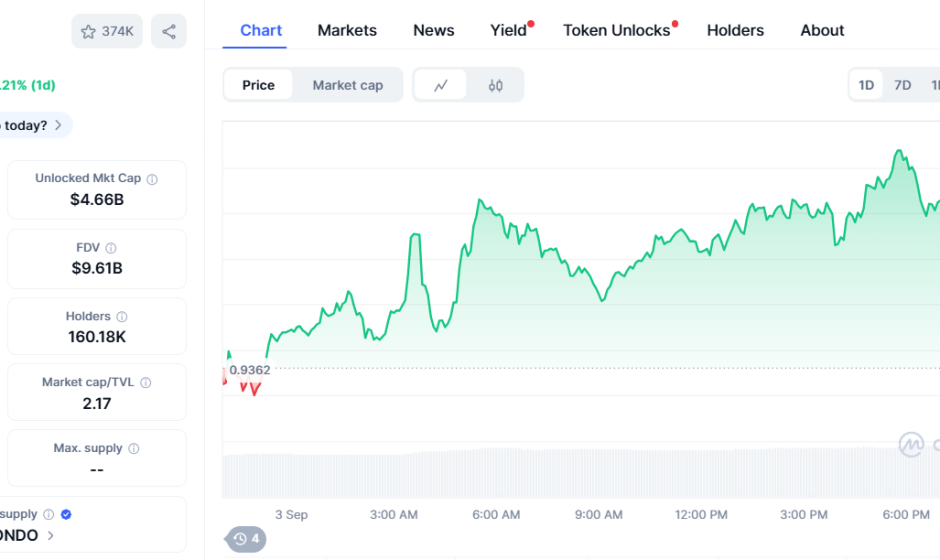

This launch drew significant attention from traders in Asia and Europe, who quickly moved into tokenized versions of big-cap stocks. Early figures show more than $70 million in trading activity across these assets during the first hours of operation. Additionally, the native token, ONDO, has surged by over 3% over the last 24 hours.

Ondo Debuts Global Markets with Significant Industry Support

Ondo had signaled its plan to offer 100+ tokenized stocks and ETFs earlier this week. That promise of the Ondo Global Markets is now live, with the rollout receiving backing from more than two dozen partners. These partners include exchanges, wallets, and data providers which ensures liquidity and accessibility.

1/ Wall Street 2.0 is here.

Ondo Global Markets is now live, providing one of the largest-ever selections of tokenized U.S. stocks & ETFs onchain with the liquidity of traditional finance, starting on @Ethereum.

100+ assets now live, with hundreds more on the way. pic.twitter.com/caHhT0gRX5

— Ondo Finance (@OndoFinance) September 3, 2025

Large-cap firms were among the first to see heavy activity. Tokenized shares of Google and Nvidia each logged tens of millions in volume. Nvidia alone drew attention as buyers moved quickly to secure exposure through the blockchain.

The ONDO token reacted in step with the launch. Trading data indicates slight gains for ONDO as the price rose by 3.2% in the past 24 hours, as per data by CoinMarketCap.

Ondo also registered a sharp increase in transactions as well. These numbers imply that investors believe there is a potential in the model and are early positioning. To international traders, tokenized stocks will allow them to purchase US equities which could otherwise be inaccessible.

Regardless of that momentum, the platform is not open to US-based users. Although analysts see that this may constrain broader market power, others believe that new global funding inflows might still exert indirect pressure on Wall Street.

Bridging Web3 and TradFi

Ondo Finance’s move fits within a larger pattern. On one side, Web3 firms are racing to tokenize traditional assets. In particular, US markets are preparing to open their doors to crypto. Both efforts show a growing recognition that investors want crossover exposure.

These tracks do not directly compete, but they point to the same conclusion that demand is rising from both directions. Tokenized stocks on blockchain have the potential to appeal to crypto users and traditional exchanges are considering this new digital assets frontier.

The initial reaction to Ondo Global Markets is indicative of real appetite. However, it is yet unknown whether that enthusiasm can be taken forward, and whether it will be able to affect larger markets. In the meantime, the launch has made Ondo one of the more recognizable participants in the RWA space.

#blockchain #crypto, #decentralized, #distributed, #ledger