by Vincent Muthee

South Korea’s top financial watchdog began a probe into Bithumb after the exchange briefly paid out 620,000 Bitcoin that it never owned. The error, worth roughly $43 billion at the time, rattled regulators and revived fears that some centralized exchanges could be trading Bitcoin that does not actually exist.

According to reports, the Financial Supervisory Service (FSS) opened a formal investigation on Tuesday, citing potential breaches of market rules and weak internal controls. The case has now turned into one of the most serious regulatory tests for South Korea’s crypto industry.

Bithumb’s $43B BTC Error That Shocked the Market

Bithumb admitted on Saturday that it mistakenly credited users with 620,000 BTC during a promotional campaign. The exchange said staff meant to distribute 2,000 South Korean won per user, but entered “BTC” instead of “KRW”.

Yonhap News, however, reported that the FSS has quickly stepped in after detecting a massive mismatch between Bithumb’s real Bitcoin reserves and the balances displayed to customers. Regulators found that Bithumb held only about 41,798 BTC in custody, far below the amount suddenly visible on user accounts.

An unnamed FSS official told Yonhap that the FSS now treats the incident as a systemic failure rather than a simple typo. “We are taking this case very seriously…The FSS will take stern legal actions against acts that harm the market order,” the official reportedly said.

CryptoQuant analyst Maartunn provided further evidence that the credited Bitcoin existed only inside Bithumb’s internal system, according to a report by Cointelegraph. He claimed that no corresponding on-chain movement supported the sudden 620,000 BTC increase.

Maartunn also tracked a surge in withdrawals immediately after the incident. He said about 3,875 BTC, roughly $268 million at the time, left the exchange within hours, suggesting some users capitalized on the mistake while others rushed to reduce exposure.

Single-Staff Failure Raises Red Flags

The FSS pointed to what it called a “single point of failure” inside Bithumb’s operations. Investigators say one employee controlled the payout process without adequate oversight, creating room for a catastrophic manual error.

Regulators now question whether Bithumb maintained proper separation of duties in its payment systems. The FSS signaled that similar lapses could exist across other exchanges unless firms tighten compliance structures.

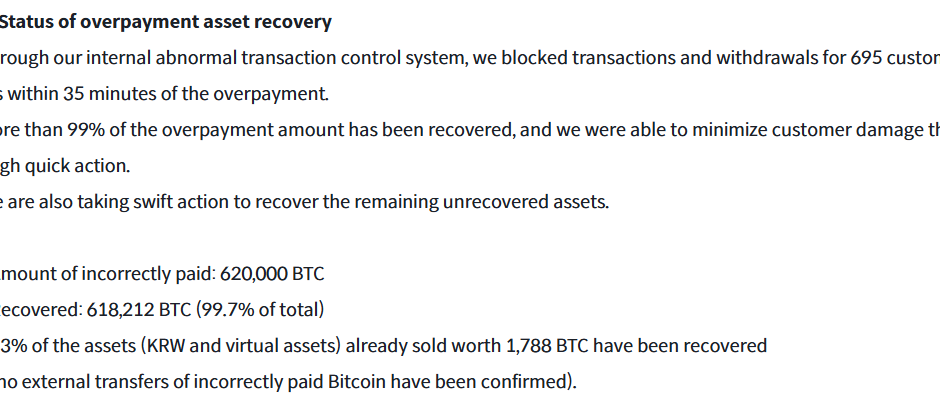

Bithumb insists that it recovered most of the miscredited Bitcoin and claims customers suffered no losses. The exchange still cannot account for roughly 125 Bitcoin, about $8.6 million, which remains unresolved.

Market participants argue that even a temporary creation of phantom Bitcoin undermines confidence in centralized trading venues. Several analysts warned that such mistakes blur the line between real reserves and book entries.

Bithumb’s Error Reignites‘Paper Bitcoin’ Debate

The Bithumb incident has fueled a broader debate over “paper Bitcoin,” a term for BTC that exchanges display but do not fully back with on-chain assets. Critics say this practice inflates supply and distorts price signals.

Some traders have attributed the Bithumb meltdown to market turbulence, with Bitcoin declining by approximately 43% since October 2025 highs. Skeptics also argue that synthetic balances on exchanges could have increased selling pressure.

Others warn that the error should not be exaggerated, as derivatives markets and ETFs also expose individuals to Bitcoin without necessarily having possession of the physical coin. Still, the Bithumb case gives regulators fresh ammunition to push for stricter reserve audits.

For now, South Korea’s investigation signals a tougher era for local exchanges. How the FSS rules on Bithumb could set precedents for transparency, staffing controls, and proof-of-reserves requirements across the industry.

#blockchain #crypto, #decentralized, #distributed, #ledger