by Vincent Muthee

The United Arab Emirates has emerged as one of the most aggressive Bitcoin accumulators through mining, not market purchases, with reports showing 6,782 BTC. New blockchain data from Arkham Intelligence shows that these assets were accumulated from a major mining operation tied to Abu Dhabi’s partner Citadel Mining.

These coins are now worth approximately $454 million and echoes UAE’s quiet BTC accumulation as it moves to build large BTC reserves. So far, the nation sits on $344 million in unrealized profits.

UAE’s Mining Operation Focuses on Long-Term Holding

Citadel Mining, the Bitcoin mining partner of the UAE, has maintained a steady accumulation strategy since launch. Instead of selling mined Bitcoin during price rallies, the company has retained most of its holdings. Blockchain records show consistent inflows from mining pools such as Foundry Digital, with almost no major outflows in recent months.

The operation runs from Abu Dhabi and benefits from access to affordable energy and advanced infrastructure. Royal Group, chaired by Sheikh Tahnoon bin Zayed Al Nahyan, supports the mining effort as part of its broader investment activity across technology and emerging sectors.

Citadel developed its facility in partnership with Phoenix Group in 2022. Since then, the site has mined BTC worth $454 million, while maintaining efficient operations. This approach allows the group to accumulate BTC directly instead of competing with institutional buyers on exchanges.

THE UAE MINED $450M BITCOIN

The UAE has so far mined $453.6M Bitcoin through their partners Citadel. It appears that they are holding the majority of the Bitcoin they produce, with their most recent outflows 4 months ago.

Excluding energy costs, the UAE is currently in profit… pic.twitter.com/HcB2CYBQgy

— Arkham (@arkham) February 19, 2026

Royal Group’s Bitcoin holdings do not sit inside sovereign wealth funds such as Abu Dhabi Investment Authority or ADQ. However, its close connections to Abu Dhabi leadership have led analysts to view the mining activity as part of a wider national strategy to gain exposure to digital assets.

UAE Expands Bitcoin Exposure Across Institutions

The UAE has increased its Bitcoin exposure beyond mining. Mubadala Investment Company recently expanded its spot Bitcoin ETF holdings by 45%, bringing its allocation to roughly $630 million. The move portrays increased institutional belief in Bitcoin as a long-term asset.

Dubai and Abu Dhabi have also developed transparent regulatory frameworks to attract crypto firms and investors. As a result, there is an increase in the number of exchanges, blockchain startups, and infrastructure providers in the region. These advancements contribute to the ambition of the UAE to establish itself as a digital finance hub on the global stage.

Mining is a major part of this strategy. By mining Bitcoin locally, the UAE aims to hoard this crypto without buying it on the market, a move that could potentially affect the price of Bitcoin.

Exchange Outflows and Holder Activity Reduce Available BTC Supply

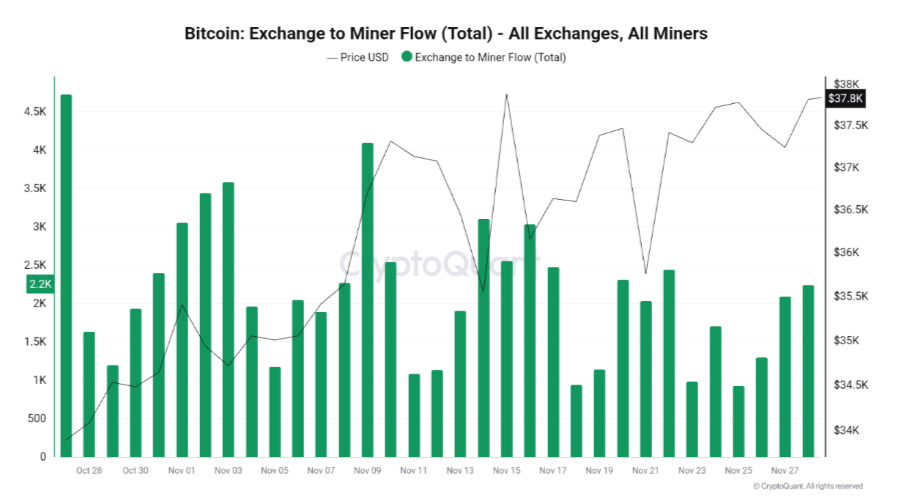

Recent on-chain data shows a wider trend of Bitcoin accumulation among miners and long-term holders. A CryptoQuant report shows that more than 36,000 BTC have left exchanges since early February. Binance alone registered withdrawals of more than 12,000 BTC.

Massive withdrawals are usually an indicator of long-term storage and not a direct sale. Investors usually withdraw Bitcoin into private wallets, thus reducing the supply available on exchanges.

Additionally, long-term holders have added more than 380,000 BTC over the last 30 days. This trend demonstrates strong conviction among institutional investors, miners, and strategic investors.

As of the time of publication, Bitcoin traded at $66,969, recording a 0.8% surge on the 24-hour timeframe. The king crypto recorded an intra-day low of $65,733 and an intra-day high of $67,202.

#blockchain #crypto, #decentralized, #distributed, #ledger