by Vincent Muthee

Dogecoin has captured Wall Street’s attention after the first U.S Dogecoin exchange-traded fund (ETF) launched with record-breaking demand. The Rex-Osprey DOGE ETF opened trading last week and stunned markets by pulling in $6 million in volume within its first hour. That figure was almost six times higher than the average debut session for new ETFs.

This strong start is an indicator of a turnaround for the meme coin. Dogecoin, which was initially regarded as a lightweight meme coin, is now receiving the serious consideration of both individual traders and institutional investors. Analysts suggest that the ETF launch provides the cryptocurrency with the liquidity foundation that it has been lacking, and that may change its price pattern over the next several months.

ETF Launch Pushes DOGE Into Spotlight

The Rex-Osprey ETF debut has fueled optimism across the Dogecoin crypto community. Bloomberg analyst Eric Balchunas had predicted only $2.5 million in trading for the entire first day, but demand blew past that target within an hour. The launch also outperformed several earlier digital asset funds that struggled to clear $1 million in debut trading volume.

Momentum around the asset has also continued to grow even further. The Dogecoin ETF has now recorded $8.7 million inflows, as per reports.

#Dogecoin ETF has already seen more than $8.7 million in inflows.

Massive debut. pic.twitter.com/4OD2DRwbKP

— dogegod (@_dogegod_) September 26, 2025

Additionally, the Depository Trust & Clearing Corporation (DTCC) recently listed a proposal for a 21Shares spot DOGE ETF, a signal that more products could be on the way. At the same time, the U.S Securities and Exchange Commission (SEC) is reviewing fresh applications from Grayscale and Bitwise, with October 17 circled as a deadline for a decision.

The strong performance of the first DOGE ETF may improve approval odds for these filings. Analysts say that if regulators sign off on additional Dogecoin funds, the asset could follow a similar path to Bitcoin and Ethereum, both of which saw trading volumes surge after their spot ETFs entered the market.

Dogecoin Price Action

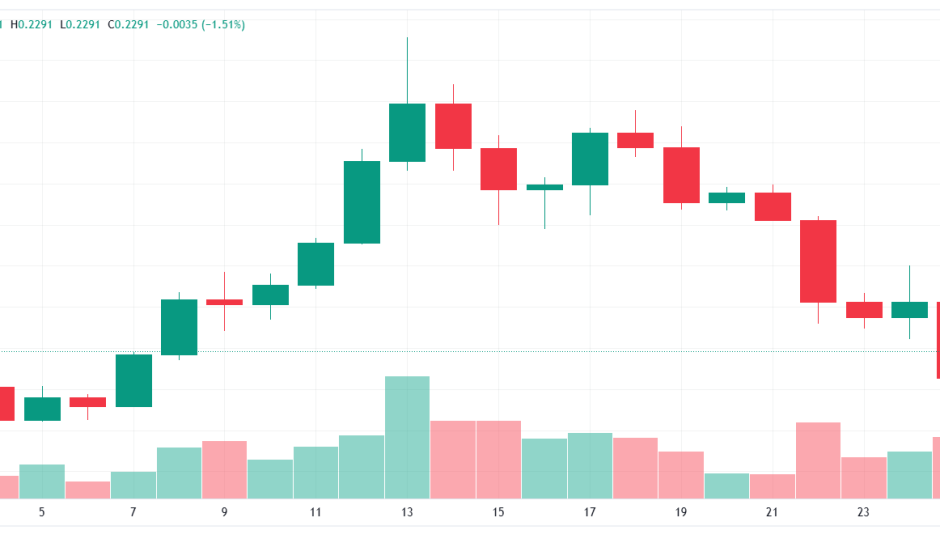

Markets responded immediately to the Rex-Osprey ETF launch. Dogecoin jumped 5.12% in 24 hours to hit $0.28, then pushed higher to an intraday peak of $0.285 on September 18. Traders saw the move as the start of a short-term rally fueled by ETF inflows.

After the burst, prices consolidated above the breakout range. Resistance levels formed around $0.39. However, a sharp correction followed, sending DOGE down to $0.22. Despite that drop, bulls pointed out the token is still holding a strong base near $0.20, which could act as a launchpad for the next leg higher.

Analyst Predicts Third Bullish Cycle

Crypto strategist Ether Nasyonal has turned particularly bullish for Dogecoin. In a post shared on X, he noted that Dogecoin’s current chart mirrors setups seen before its last two major bull cycles. According to him, the “third cycle is inevitable,” with accumulation and breakout signals lining up once again.

Ether Nasyonal argues that the timing of the ETF launch could be critical. With institutional money flowing in and investor sentiment heating up, he believes the stage is set for Dogecoin’s most significant rally yet.

However, while the Rex-Osprey DOGE ETF has stirred fresh attention for Dogecoin, investors must remain cautious. DOGE is highly volatile and not until bulls back an upward price movement, it could plunge any time, especially if the sentiment across the general crypto market remains negative.

#blockchain #crypto, #decentralized, #distributed, #ledger